AIAM Foundation Donor Impact

Your generous gift to the AIAM Foundation can transform what is possible for our businesses, communities, and individuals working in and alongside the aerospace industry in Michigan.

Maximize Your Gift

Make an immediate impact with a tax-deductible donation today. The Foundation offers a variety of options to make a gift that best meets your life circumstances and the desired impact made. Choose from one of the options below, or for additional information, contact us.

One-Time Gift

Gift Pledge Paid Over Time

Qualified Charitable Deduction (QCD)

If you have an IRA and are 70.5 years old or older, this is a great option for you to make a charitable gift to the Foundation.

A QCD, also known as an IRA charitable distribution or IRA Charitable rollover allows an individual to take their required minimum distribution from their taxable IRA by a direct transfer to charity. QCDs are not taxable income and are not counted toward the maximum amounts deductible for those who itemize their giving on their taxes. Ask your financial advisor if this is the right option for you.

Recurring Gift

A monthly gift provides reliable funds for the foundation to seamlessly support vital programming to Michigan communities. It also enables donors to increase the size of their giving in a manageable and consistent manner.

Be a partner in mission and set up your monthly recurring gift today, by visiting this link.

Stocks and Mutual Funds

Maximize your charitable giving and tax savings by considering a gift of stocks, bonds, or mutual funds. We recommend working with your tax or financial advisor to learn how you can realize a tax benefit by making a charitable investment in the mission of the Foundation.

For more information on how to make a gift of stock please reach out to Brittany Telander, Executive Director.

Corporate Partners Program

The Foundation invites Michigan businesses to invest in the future of the communities where they operate and where their employees live by becoming an AIAM Foundation Corporate Partner. This program enables companies to support programs that add value to their communities and families while receiving meaningful recognition benefits.

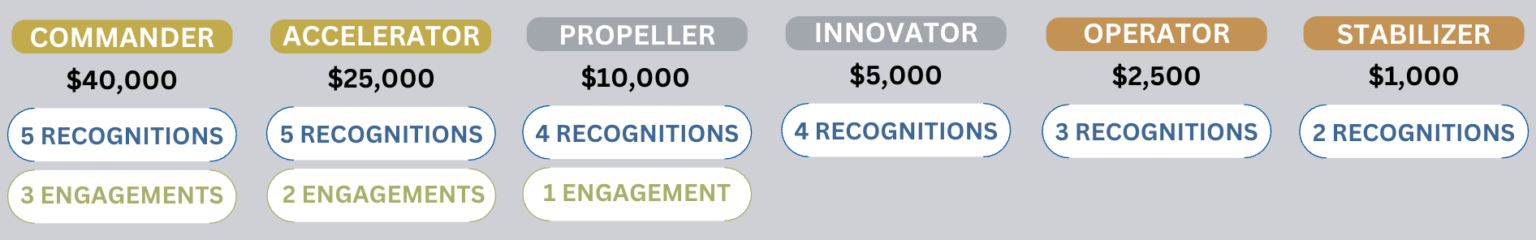

Corporations have several levels for consideration through the Foundation Corporate Partners Program. This allows businesses of all sizes to make a difference in the community and the broader state of Michigan. Additionally, corporate partners may select from a range of benefits to receive for their generous gift. Explore what level best fits your business goals and philanthropic interests to impact the communities and families in Michigan.

Explore below what level works best for your business and secure your Corporate Partnership today!